Giving your life savings to a stock broker/portfolio manager is scary. Being able to review your accounts, with straight-forward descriptions can give you peace-of-mind.

Investaware is a first of its kind iPad app that helps you follow and understand the actions made by your wealth manager. Developed by an expert who spent decades creating analytic reporting solutions for the world’s top hedge fund managers, these tools are now available for you and your investments.

Analyze your portfolio. Summarize and review trading activity. Read recaps of your monthly and inception-to-date performance. All using straight-forward graphs and conversational English. In other words, without the typical Wall Street mumbo-jumbo.

Utilizing the latest data visualization techniques and natural language generation (yep artificial intelligence) Investaware provides an unprecedented lucid view of your investments.

How Investaware works

Investaware imports positions and trade information from your brokers. It then performs a detailed analysis, categorizes holdings, compares the performance against a wide range of benchmarks, and then builds easy to read narratives and graphs. Technically this is referred to as a “bottom up approach”. This is all done on your iPad. No data leaves your device.

Investaware Features

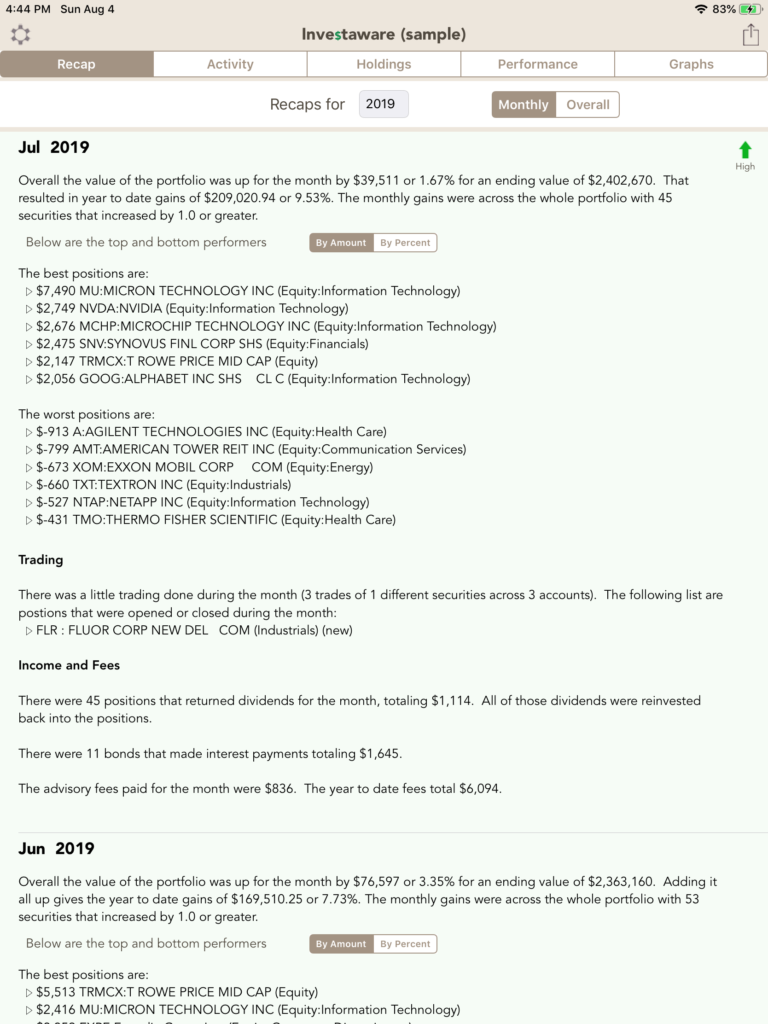

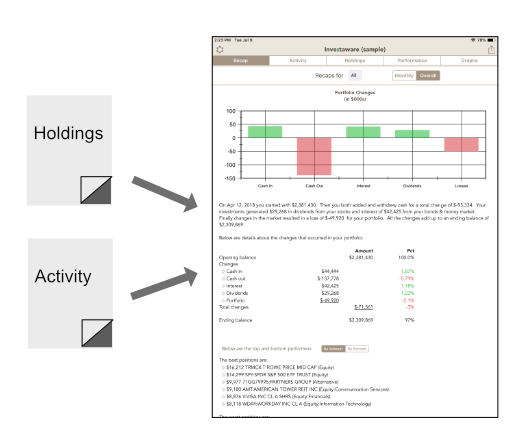

- Recaps

Using a natural language generator the app summaries all aspects of how your investments are doing.

You’ll get an overview of the performance, effects of significant trades, and the top/bottom positions. You can flip between monthly recaps as well as year-to-date or an inception-to-date recap.

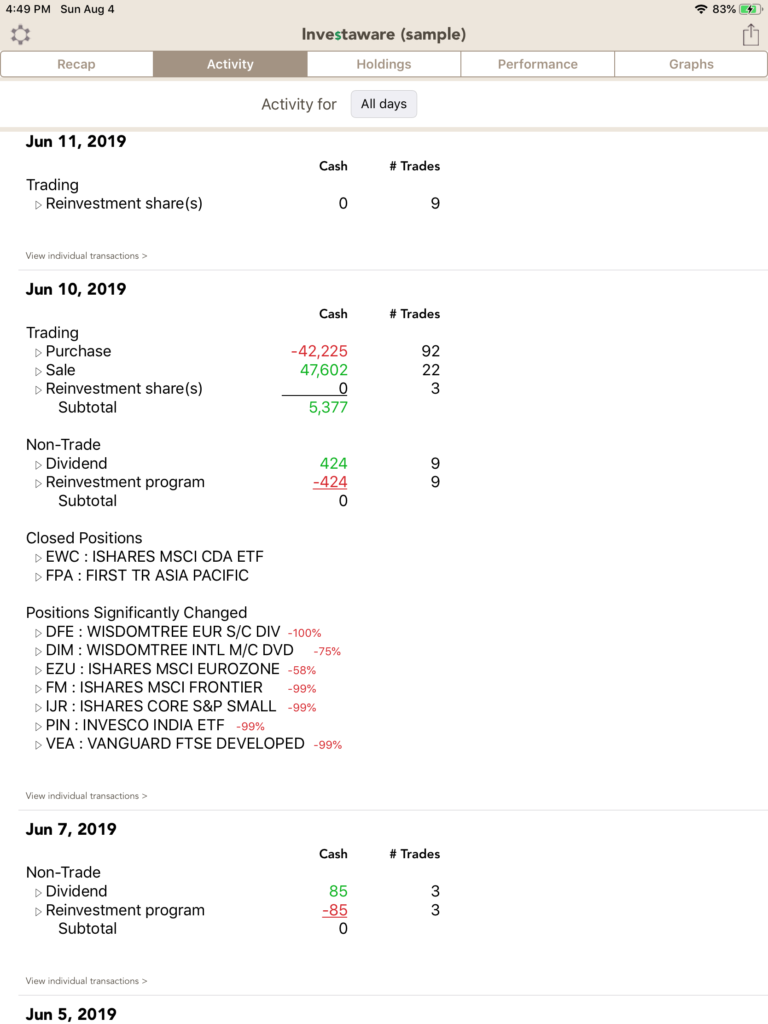

- Activity

If you ever come home to find your mailbox loaded with trade confirms, you know that brokerage firms are good at generating documents. All the details related to each trade is printed on a separate piece of paper. Heck, telling your broker to go paperless only means that you’re scrolling through page after page on your browser. All the while you’re wondering what the effect of this activity has on your portfolio. Did the broker significantly change the exposure to equities or are they just cleaning up fractional shares?

Investaware takes away the guesswork by analyzing all the activity and generating simple overviews as to what effect the trades had. You still can view all the trade executions in the app, but at least now you don’t HAVE to.

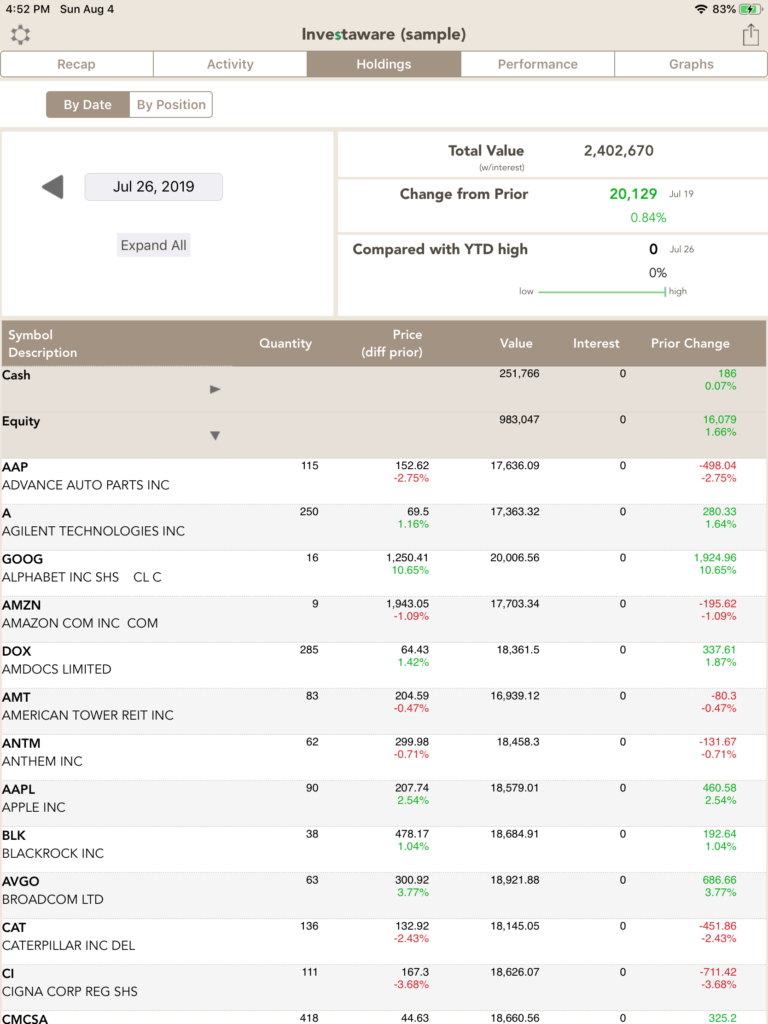

- Holdings

All your historic positions are stored so after importing new data, you can compare the current positions against prior positions. This can be viewed either by date or by position (across the lifetime of the investment).

For positions you don’t to sell (such as bonds you plan to hold to maturity), you can tell Investaware to value them at cost. This prevents your reports to be tainted by market fluctuations that don’t matter to you. Yet another place where Investaware goes beyond most systems.

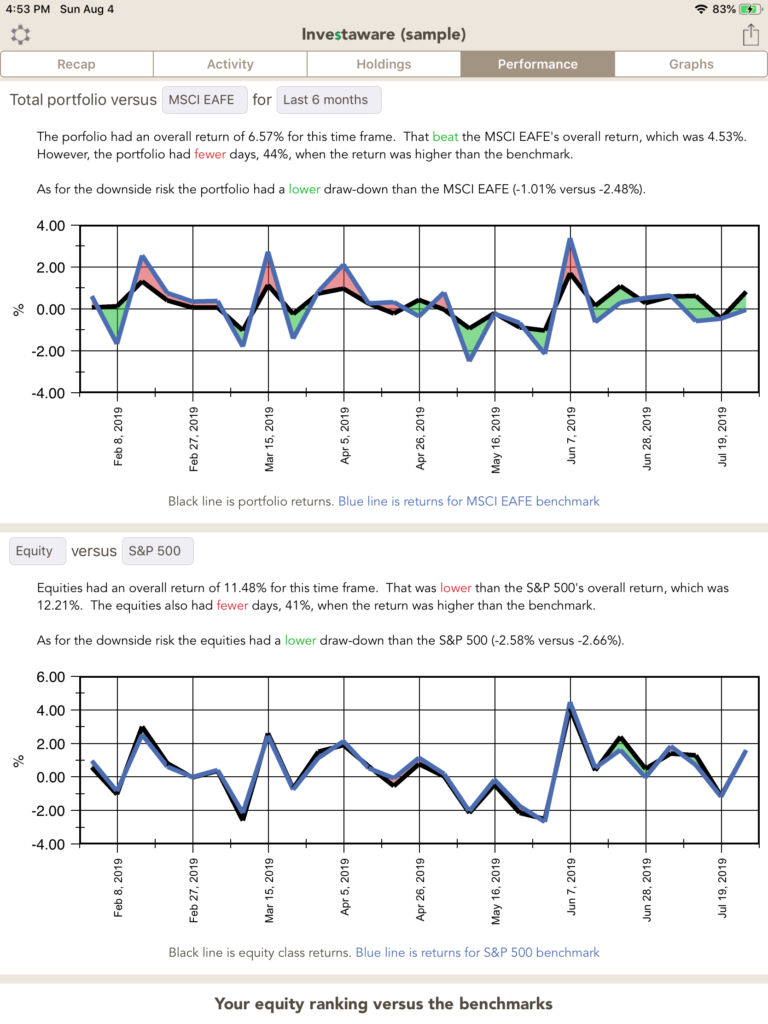

- Performance

You can see how the entire portfolio compares against your chosen benchmark. Alternatively you can compare one particular asset class against a benchmark (for example your stocks versus the S&P 500. Separately the app will list all the available benchmarks and how your asset class ranks against those benchmarks. All of this functionality is based upon a time frame that you can change on the fly.

But Investaware doesn’t stop there. It also calculates the risk of the benchmarks and your portfolio/asset classes and shows how your accounts compare.

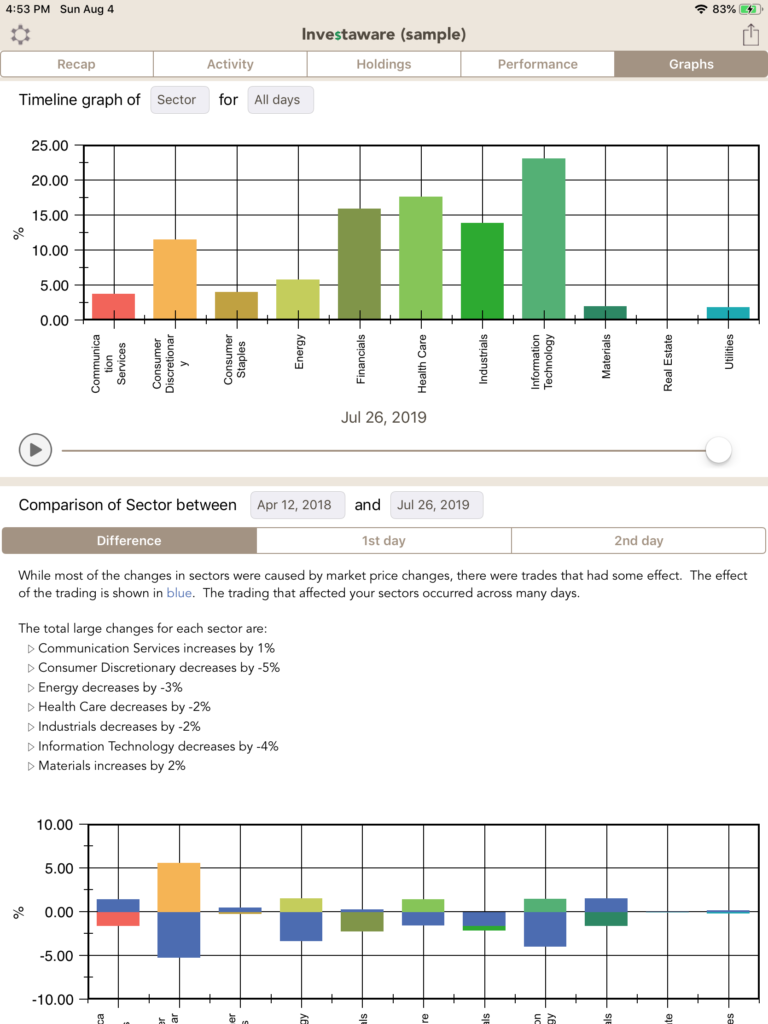

- Sectors

Sure like most systems, the app will show you the breakdown of your positions according to sector. However, it doesn’t stop there; in order to understand how your portfolio is being managed, the system ALSO presents the sectors changes from a prior date. Wait, we don’t stop there; Investaware does a deep analysis to determine how much of that change was caused by trades versus market fluctuations.

Using Investaware

For more detail on using Investaware, view the online help.